Introduction: Payslip Compliance Goes Beyond Paperwork

The Ministry of Manpower (MOM) has required all employers under Singapore’s Employment Act (EA) to give itemised payslips to their employees since 1 April 2016.

This rule does more than just add paperwork — it forms the basis of payroll transparency and compliance. An itemised payslip helps employees grasp their salary calculations and shields employers from disagreements.

Singapore employers covered by the Employment Act must provide MOM-compliant itemised payslips with each salary payment.

What Is An Itemised Payslip?

An itemised payslip serves as a comprehensive document accompanying each wage payment. It breaks down how an employee’s salary gets calculated — showing all earnings, subtractions, and payments.

Common Elements Include:

- Gross Salary – sum before subtractions.

- Net Salary – amount you take home.

- Allowances – perks for transport, meals, or shifts.

- Overtime Pay – for extra hours on the job.

- Deductions – CPF, income tax, or other approved amounts.

This clarity helps employees to check their wages, CPF payments, and overtime figures .

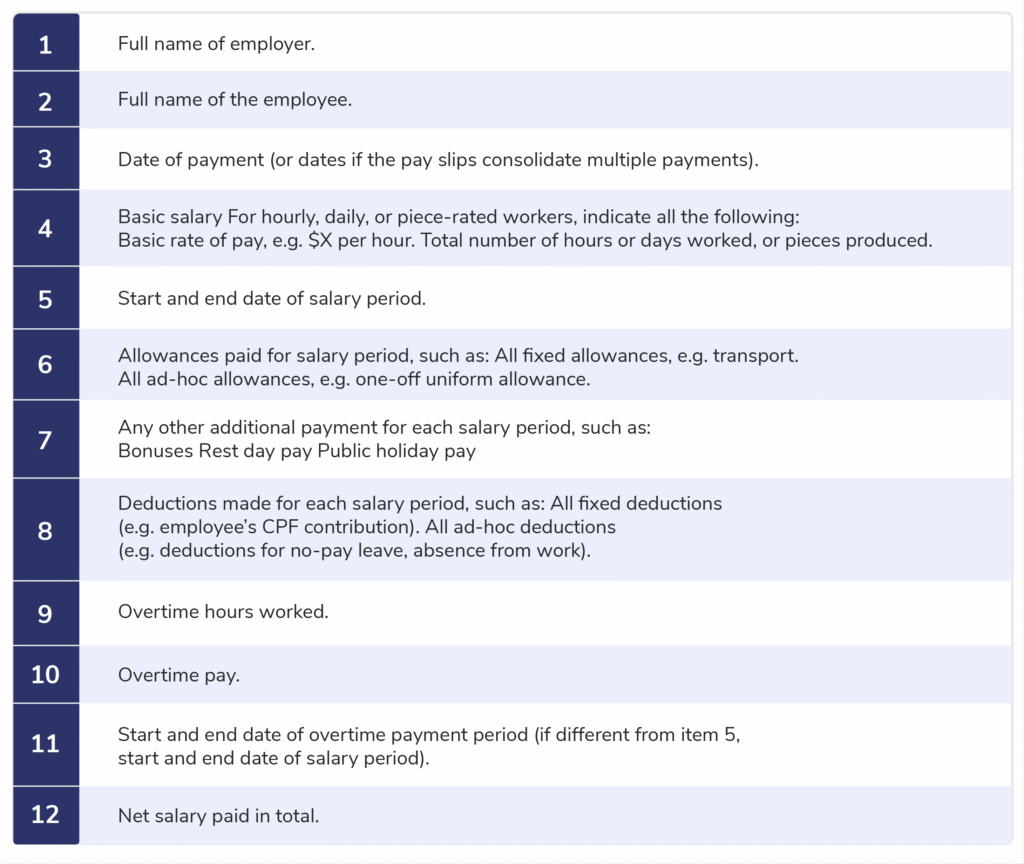

What Should a MOM-Compliant Payslip Include?

Singapore’s Ministry of Manpower (MOM) states that every payslip needs to include:

Source: Ministry of Manpower

A payslip that follows MOM rules needs to list basic pay, extras, subtractions, and the final take-home pay.

When Should Employers Give Out Payslips?

The Employment Act says Employers must give out payslips once a month at least, and they need to stick to these rules:

- With Payment: Hand over the payslip when the salary gets paid.

- Within 3 Workdays: If not given with the money, hand it over within three workdays after paying the salary.

- Upon Termination: Give the payslip with any leftover or final pay.

Keeping Records: How Long Should You Keep Payslips?

Employers have a legal obligation to hold onto payslip records for a minimum of two years, including those of employees who no longer work for the company.

This practice ensures clarity, helps with audits, and provides evidence if salary disputes arise or MOM conducts inspections.

Employers need to keep payslip records for two years for both current and former employees.

Issues When Handling Itemised Payslips Manually

Making accurate payslips takes a lot of time and can lead to errors. Common problems include:

- Complex Calculations – Companies must figure out basic pay, overtime, allowances, CPF, and taxes.

- Regulatory Compliance – MOM changes rules from time to time; doing things by hand might not follow the latest rules.

- Data Accuracy – Mistakes in attendance or payroll info lead to wrong pay.

- Data Security – Printed payslips or unprotected spreadsheets might expose private details.

Manual processing can also hold up paychecks and upset employees in growing SMEs.

Make Compliance Easy With Info-Tech Payroll Software

InfoTech’s Payroll Software takes away the hassle of manual payroll by creating MOM-compliant itemised payslips on its own — making sure everything is correct, follows rules, and works well.

Key Benefits:

- Auto-calculation of Pay Components – salary overtime, CPF, and deductions.

- Digital Payslip Generation in Seconds – send payslips through web or mobile.

- Built-in Regulatory Updates – always follows MOM rules.

- Smooth Integration – connects with Info-Tech’s HRMS to get attendance and leave info.

- Safe Cloud Storage – check payslip records anytime for audits or when employees ask.

When HR teams use this to create payslips, they save many hours each month and don’t have to worry about mistakes or late hand-ins.

📞 Want To Make Payroll Easier? Ring +65 6297 3398 or drop an email to sales@info-tech.com.sg now.

Why Compliance and Automation Go Hand in Hand

MOM’s payslip rules aim to protect Employers and employees. Using technology:

- Helps follow Singapore’s work laws.

- Shows how pay is broken down.

- Lowers the chance of fines and arguments.

As small businesses grow, payroll software isn’t just about saving time — it’s key to following rules and looking professional.

Frequently Asked Questions:

What’s a MOM-compliant itemised payslip?

It’s a pay statement that shows a detailed breakdown of earnings, deductions, CPF, and take-home pay, as the Employment Act requires.

Do Singapore employers have to give out itemised payslips?

Yes. Since April 1, 2016, the Employment Act mandates all covered employers to provide itemised payslips to their employees.

How should employees receive payslips?

At least once every month — either when they get paid or within three work days after their salary goes through.

For how long do employers need to keep payslip records?

Employers must hold onto payslip records for a two-year period covering both present and past employees.

How can businesses make sure their MOM payslips follow the rules without much trouble?

Companies can use Info-Tech’s Payroll Software This program does the math on its own, puts payslips in the right format, and keeps records safe.